When it comes to understanding and optimizing automotive insurance quotes in the Netherlands, drivers need to be well-informed about various factors that can affect their premiums. From common mistakes to avoiding pitfalls, this guide will provide valuable insights on how to navigate the world of insurance quotes effectively.

As we delve into the intricate details of insurance optimization, drivers will gain a deeper understanding of the nuances involved in securing the best insurance coverage for their vehicles.

Understanding Automotive Insurance Quotes

When it comes to obtaining automotive insurance quotes, there are several key factors that influence the cost. It's important for Netherlands drivers to understand these factors to make informed decisions and get the best possible rates. One of the primary factors that impact insurance quotes is the type of vehicle being insured.

Different vehicle types can have varying levels of risk associated with them, which in turn affects the cost of insurance.

Impact of Vehicle Types on Insurance Quotes

- Luxury vehicles and sports cars are typically more expensive to insure due to their higher value and increased risk of theft or accidents.

- Eco-friendly cars, on the other hand, may qualify for discounts as they are seen as less risky and environmentally friendly.

- Older cars with high mileage may have higher insurance rates due to increased likelihood of mechanical issues.

Accurate information is crucial when requesting insurance quotes as any discrepancies or inaccuracies can result in incorrect pricing. It's important to provide details about your driving history, the intended use of the vehicle, and any safety features it may have.

By being transparent and providing accurate information, you can ensure that you receive quotes that accurately reflect your needs and circumstances.

How to Optimize Automotive Insurance Quotes

When it comes to getting the best deal on automotive insurance in the Netherlands, there are several strategies that drivers can use to optimize their insurance quotes. By comparing different insurance providers, customizing coverage, and seeking out discounts, drivers can ensure they are getting the most value for their money.

Comparing Insurance Providers

To optimize your automotive insurance quote, it is essential to compare different insurance providers in the Netherlands. Each insurance company may offer different rates and coverage options, so it is crucial to shop around and get quotes from multiple providers.

By comparing prices and coverage details, drivers can find the best deal that fits their needs and budget.

Customizing Coverage

Customizing your insurance coverage is another way to optimize your automotive insurance quote. By tailoring your coverage to your specific needs, you can avoid paying for unnecessary coverage while ensuring you have adequate protection. Whether you need comprehensive coverage, liability insurance, or additional benefits like roadside assistance, customizing your policy can help you get the most value out of your insurance plan.

Seeking Discounts

In addition to comparing providers and customizing coverage, drivers in the Netherlands can also optimize their automotive insurance quotes by seeking out discounts. Many insurance companies offer discounts for various factors such as safe driving records, multiple policies, or vehicle safety features.

By taking advantage of these discounts, drivers can lower their insurance premiums and save money in the long run.

Common Mistakes to Avoid

When seeking automotive insurance quotes, it's crucial to be aware of common mistakes that can impact the accuracy of the quotes you receive. By avoiding these pitfalls, you can ensure that you are getting a more precise quote tailored to your needs.

Providing Incorrect Information

- One of the most common mistakes drivers make is providing incorrect or inaccurate information when requesting insurance quotes. This can include details about your driving history, vehicle specifications, or personal information.

- Incorrect information can lead to quotes that do not accurately reflect your risk profile, potentially resulting in higher premiums or coverage that does not adequately protect you.

- To avoid this mistake, double-check all the information you provide when requesting insurance quotes. Make sure to provide accurate details to ensure the quotes you receive are as precise as possible.

Not Comparing Multiple Quotes

- Another common mistake is not taking the time to compare multiple insurance quotes from different providers. Failing to shop around can result in missing out on potential savings or better coverage options.

- Each insurance provider uses its own criteria to determine premiums, so comparing quotes can help you find the best deal that meets your needs and budget.

- To avoid this mistake, make sure to obtain quotes from at least three different insurance companies. Compare the coverage, premiums, and deductibles offered to make an informed decision.

Ignoring Discounts and Savings Opportunities

- Drivers often overlook discounts and savings opportunities that could help lower their insurance premiums. This includes discounts for safe driving, multi-policy discounts, and discounts for installing safety features in your vehicle.

- By ignoring these opportunities, you may end up paying more for your insurance than necessary. Taking advantage of discounts can help you save money while still getting the coverage you need.

- To avoid this mistake, ask insurance providers about available discounts and savings options. Make sure to explore all possibilities to maximize your savings.

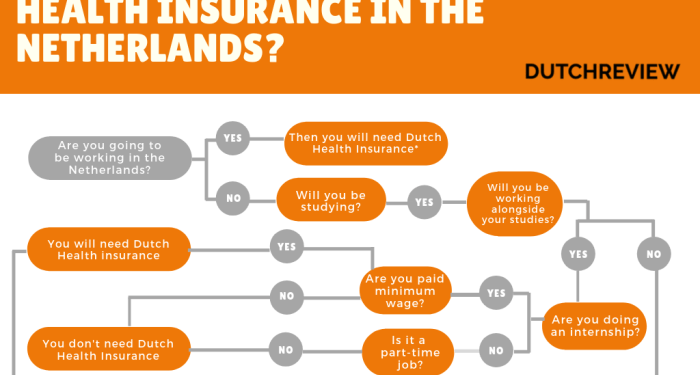

Understanding Dutch Insurance Regulations

In the Netherlands, automotive insurance is regulated to ensure drivers have the necessary coverage in case of accidents or damages. Understanding these regulations is crucial for optimizing insurance quotes and complying with the law.

Mandatory Coverage Requirements

- All drivers in the Netherlands are required to have at least third-party liability insurance. This coverage will compensate for damages caused to others in an accident where the driver is at fault.

- Additional coverage options include comprehensive insurance, which covers damages to your own vehicle, and legal assistance insurance, which provides support in legal matters related to your vehicle.

- Drivers must carry proof of insurance at all times while driving, and failure to do so can result in fines or penalties.

Optimizing Insurance Quotes through Regulations

- By understanding the mandatory coverage requirements in the Netherlands, drivers can choose the right level of coverage to meet their needs while staying compliant with the law.

- Drivers can also explore different insurance providers and compare quotes to find the best deal that meets the required regulations without overspending on unnecessary coverage.

- Being informed about Dutch insurance regulations can help drivers make informed decisions when selecting insurance policies and optimizing their quotes for maximum benefit.

Last Word

In conclusion, by grasping the essential elements of automotive insurance optimization, drivers in the Netherlands can make informed decisions that not only save them money but also provide them with the peace of mind that comes with comprehensive coverage. With this knowledge at hand, drivers can confidently navigate the insurance landscape and secure the best possible quotes for their vehicles.

FAQ Resource

What factors influence the cost of automotive insurance quotes?

The cost of automotive insurance quotes is influenced by factors such as the driver's age, driving record, type of vehicle, and location.

How can Netherlands drivers optimize their automotive insurance quotes?

Netherlands drivers can optimize their insurance quotes by comparing different providers, providing accurate information, and customizing coverage to suit their needs.

What are some common mistakes to avoid when seeking insurance quotes?

Common mistakes include providing inaccurate information, not comparing quotes, and underestimating coverage needs.

What are the mandatory coverage requirements for drivers in the Netherlands?

Drivers in the Netherlands are required to have at least third-party liability insurance to cover damages to others in case of an accident.