Kicking off with Automotive Insurance Quote Trends in Saudi Arabia – What’s Changing?, this opening paragraph is designed to captivate and engage the readers, setting the tone casual formal language style that unfolds with each word.

Exploring the dynamic landscape of automotive insurance in Saudi Arabia reveals intriguing shifts and trends that are shaping the industry. From key players to regulatory frameworks, the scene is evolving rapidly.

Overview of Automotive Insurance in Saudi Arabia

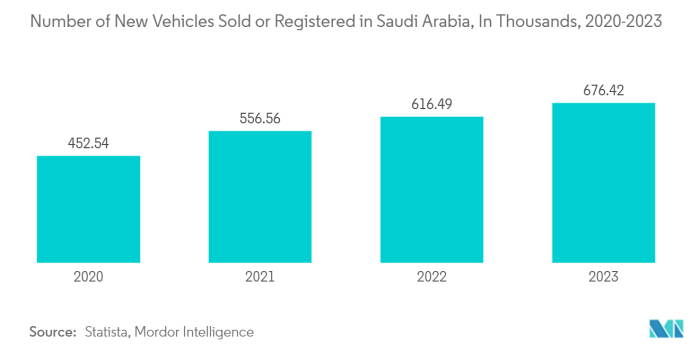

Automotive insurance in Saudi Arabia is a crucial aspect of vehicle ownership, providing financial protection in the event of accidents, theft, or other damages. The industry is experiencing significant growth, driven by the increasing number of vehicles on the road and the rising awareness of the importance of insurance coverage.

Current Landscape of Automotive Insurance

The automotive insurance market in Saudi Arabia is dominated by both local and international insurance companies. These companies offer a range of insurance products tailored to meet the diverse needs of vehicle owners in the country. With the government's push for mandatory insurance coverage, the market is expanding rapidly, creating more opportunities for insurers to tap into this growing segment.

Key Players in the Automotive Insurance Industry

Some of the key players in the automotive insurance industry in Saudi Arabia include Tawuniya, Bupa Arabia, and Medgulf. These companies have established a strong presence in the market and offer competitive insurance packages to attract customers. Additionally, there are several other insurance providers operating in the country, providing customers with a wide array of options to choose from.

Regulatory Environment

The regulatory environment governing automotive insurance in Saudi Arabia is overseen by the Saudi Arabian Monetary Authority (SAMA). SAMA plays a crucial role in ensuring that insurance companies comply with the regulations and guidelines set forth to protect the interests of policyholders.

The authority also works towards enhancing transparency and accountability within the industry to promote a fair and competitive market for automotive insurance.

Factors Influencing Automotive Insurance Trends

The automotive insurance landscape in Saudi Arabia is constantly evolving, driven by various factors that shape pricing, coverage, and overall trends in the industry. Understanding these key factors is crucial for both insurance providers and consumers to navigate the changing landscape effectively.

Economic Conditions Impact

Economic conditions play a significant role in shaping automotive insurance trends in Saudi Arabia. Fluctuations in the economy can impact consumer behavior, leading to changes in demand for insurance products. For example, during times of economic uncertainty, consumers may opt for basic insurance coverage to save costs, while in prosperous times, they may invest in more comprehensive plans.

Additionally, inflation rates, currency exchange rates, and overall market stability can influence insurance pricing and availability.

- The economic downturn caused by the COVID-19 pandemic led to a shift in consumer priorities, with many opting for more affordable insurance options.

- Conversely, periods of economic growth have seen an increase in demand for luxury car insurance coverage among high-income individuals.

Role of Technology

Technology has been a driving force in shaping automotive insurance trends in Saudi Arabia, revolutionizing the way policies are purchased, managed, and claimed. The adoption of telematics devices, artificial intelligence, and digital platforms has enabled insurers to offer personalized pricing, streamline claims processes, and enhance overall customer experience.

Technological advancements have paved the way for usage-based insurance models, where premiums are calculated based on individual driving behavior, leading to more tailored and cost-effective insurance solutions.

- Telematics devices installed in vehicles allow insurers to track driving habits such as speed, acceleration, and braking, providing valuable data for risk assessment and pricing.

- Digital platforms and mobile apps have made it easier for consumers to compare insurance quotes, purchase policies online, and file claims electronically, improving accessibility and convenience.

Emerging Trends in Automotive Insurance Quotes

As the automotive insurance landscape in Saudi Arabia continues to evolve, several emerging trends are shaping the way insurance quotes are determined. These trends are influenced by customer preferences, new products, and services, ultimately impacting pricing strategies in the market.

Personalized Insurance Packages

Insurance providers in Saudi Arabia are increasingly offering personalized insurance packages tailored to individual customer needs. By analyzing customer data and driving behavior, insurers can create customized plans that not only provide adequate coverage but also offer competitive pricing based on specific risk profiles.

Integration of Technology

The integration of technology, such as telematics devices and mobile apps, is revolutionizing the way insurance quotes are calculated. Insurers can now track real-time driving data to assess risk more accurately, leading to more personalized and dynamic pricing models

Rise of Insurtech Companies

The emergence of Insurtech companies in Saudi Arabia is introducing innovative products and services that are disrupting traditional insurance practices. These companies leverage technology to streamline processes, offer faster claims processing, and provide more affordable insurance options. As Insurtech continues to gain momentum, it is likely to influence pricing trends and drive competition among insurers.

Comparison of Traditional vs. Online Insurance Quotes

When it comes to obtaining automotive insurance quotes, there are two main methods: traditional offline approaches and the more modern online platforms. Each method has its own set of advantages and disadvantages, and the shift towards online quoting systems is changing the landscape of the insurance industry in Saudi Arabia.

Advantages and Disadvantages of Online Insurance Quoting Systems

Online insurance quoting systems offer several benefits, such as:

- Convenience: Customers can easily obtain quotes from the comfort of their own homes without the need to visit a physical office.

- Speed: Online quotes are generated almost instantly, saving time for both the customer and the insurance company.

- Comparison: Customers can compare quotes from multiple insurers quickly and efficiently to find the best deal.

However, online insurance quoting systems also have their drawbacks, including:

- Lack of Personalization: Online quotes may not take into account specific individual circumstances, leading to potentially inaccurate estimates.

- Data Security: Customers may have concerns about the security of their personal information when entering it online.

- Limited Assistance: Some customers prefer the personal touch of interacting with an insurance agent when obtaining quotes.

Adaptation of Traditional Insurance Companies to Online Quotes

Traditional insurance companies are recognizing the importance of adapting to the shift towards online quoting systems. They are:

- Developing Online Platforms: Traditional insurers are investing in user-friendly online portals to offer customers the convenience of obtaining quotes digitally.

- Providing Hybrid Options: Some companies are offering a combination of online and offline services to cater to a wider range of customers.

- Enhancing Customer Service: Traditional insurers are focusing on improving their online customer service to provide a seamless experience for those obtaining quotes digitally.

Conclusive Thoughts

In conclusion, the realm of automotive insurance in Saudi Arabia is witnessing significant transformations driven by various factors. From changing customer preferences to advancements in technology, the future holds exciting possibilities for the industry.

FAQ Resource

What factors are driving changes in automotive insurance trends in Saudi Arabia?

Economic conditions, customer preferences, and technological advancements are key influencers of automotive insurance trends in Saudi Arabia.

How do traditional and online insurance quoting systems compare?

Traditional methods provide a personal touch but can be time-consuming, while online platforms offer convenience but may lack direct interaction with agents.

What are the latest trends in automotive insurance quotes in Saudi Arabia?

The latest trends include personalized pricing based on individual driving habits, increased use of data analytics, and the introduction of innovative coverage options.