Navigating the world of car insurance as a high-risk driver in Canada can be challenging. From understanding what makes a driver high-risk to finding the best rates, this guide will provide valuable tips and insights to help you secure the coverage you need.

Explore the factors that impact insurance rates, learn strategies to lower premiums, and discover how to leverage discounts effectively.

Tips for High-Risk Drivers in Canada

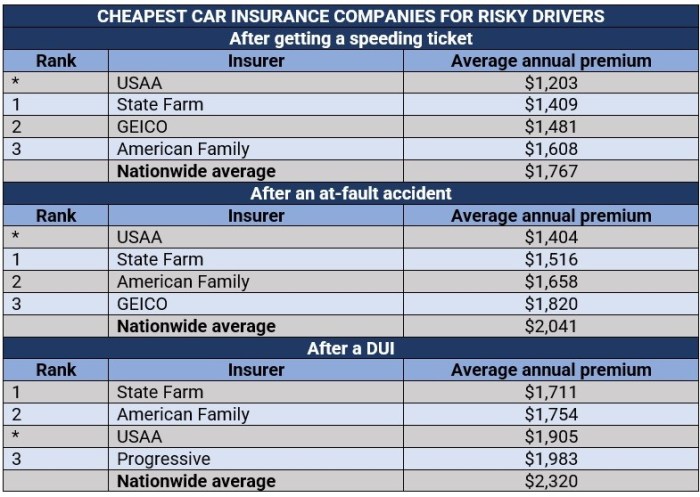

When it comes to being classified as a high-risk driver in Canada, there are certain factors that insurance companies take into consideration. These factors can include a history of accidents, traffic violations, DUI convictions, or even being a new or inexperienced driver.

Being labeled as high-risk can make it challenging to find affordable car insurance coverage.

Challenges Faced by High-Risk Drivers

- Higher premiums: High-risk drivers often face significantly higher insurance premiums compared to low-risk drivers.

- Limited coverage options: Some insurance companies may be hesitant to provide coverage to high-risk drivers, leaving them with limited options.

- Risk of policy cancellation: High-risk drivers are at a higher risk of having their policies canceled by insurance companies due to their driving history.

Importance of Shopping Around

- Compare rates: It is crucial for high-risk drivers to shop around and compare rates from different insurance providers to find the best possible coverage at an affordable price.

- Look for discounts: Some insurance companies offer discounts or special programs for high-risk drivers that can help reduce premiums.

Strategies to Improve Driving Habits

- Enroll in a defensive driving course: Completing a defensive driving course can help improve driving skills and demonstrate to insurance companies that you are committed to safe driving.

- Drive responsibly: Avoiding traffic violations and accidents can help improve your driving record over time, potentially leading to lower insurance premiums.

Understanding Discount Car Insurance Quotes

When it comes to discount car insurance quotes, it's essential to understand how insurance companies determine eligibility for discounts. Factors such as driving record, age, location, and type of vehicle can all play a role in determining the discounts you may qualify for.

Comparing Benefits of Obtaining Car Insurance Quotes from Multiple Providers

- By obtaining car insurance quotes from multiple providers, you can compare coverage options, rates, and discounts to find the best deal for your specific needs.

- Each insurance company may offer different discounts based on various criteria, so shopping around can help you find the most competitive rates.

- Additionally, getting quotes from multiple providers allows you to leverage one offer against another to negotiate for better rates or discounts.

Role of Deductibles in Obtaining Discounted Insurance Rates

- Choosing a higher deductible can often lead to lower insurance premiums, as you are taking on more financial responsibility in the event of a claim.

- Insurance companies may offer discounts for higher deductibles as it reduces their risk and potential payout in case of an accident.

- However, it's crucial to balance the savings from a higher deductible with your ability to cover that amount out of pocket in the event of a claim.

Tips on Leveraging Loyalty Programs or Bundling Policies for Discounts

- Many insurance companies offer discounts to loyal customers who renew their policies with them year after year.

- Consider bundling your car insurance with other policies, such as home or renters insurance, to receive a multi-policy discount.

- Some insurers may also offer discounts for completing safe driving courses or for having certain safety features installed in your vehicle.

Factors Influencing Car Insurance Quotes for High-Risk Drivers

When it comes to determining car insurance quotes for high-risk drivers in Canada, several factors play a significant role in influencing the premiums they are quoted. These factors can vary from driving record to age and experience, vehicle type, usage, location, and even credit history.

Understanding how these elements impact insurance rates can help high-risk drivers make informed decisions when seeking coverage.

Driving Record and Insurance Quotes

A high-risk driver's driving record is one of the most crucial factors that insurance companies consider when calculating insurance premiums. Accidents, traffic violations, and previous insurance claims can significantly impact the cost of insurance. A clean driving record typically results in lower premiums, while a history of accidents and violations can lead to higher rates.

Age and Experience Impact

Age and driving experience also play a vital role in determining insurance costs for high-risk drivers

Vehicle Type and Usage

The type of vehicle a high-risk driver owns and how they use it can affect insurance costs. Sports cars and luxury vehicles are generally more expensive to insure due to their higher repair costs and increased risk of theft. Additionally, drivers who use their vehicles for commercial purposes may face higher insurance premiums compared to those who only use their cars for personal use.

Location and Credit History

Other factors that can influence car insurance quotes for high-risk drivers include their location and credit history. Drivers living in areas with high crime rates or high traffic congestion may face higher insurance premiums. Additionally, individuals with poor credit scores may also be quoted higher rates, as insurance companies often view them as higher-risk clients.

Strategies for Lowering Car Insurance Premiums

When it comes to lowering car insurance premiums as a high-risk driver in Canada, there are several strategies you can consider. These tips can help you save money while still ensuring you have the necessary coverage in place.

Defensive Driving Courses

Taking defensive driving courses can not only improve your driving skills but also potentially lead to lower insurance premiums. Insurance companies often offer discounts to drivers who have completed these courses, as they are seen as less risky on the road.

Increasing Deductibles

One way to lower insurance costs is by increasing your deductibles. By opting for a higher deductible, you may be able to reduce your premiums. However, it's important to ensure you can afford the higher out-of-pocket costs in the event of a claim.

Installing Safety Features

Installing safety features in your vehicle, such as anti-theft devices or airbags, can also lead to insurance discounts. These features can help reduce the risk of accidents or theft, making you a less risky driver in the eyes of insurance companies.

Maintaining a Good Credit Score

Believe it or not, maintaining a good credit score can also help lower your insurance premiums. Insurance companies often use credit scores as a factor in determining rates, so having a good credit history can work in your favor when it comes to securing lower premiums.

End of Discussion

In conclusion, being a high-risk driver doesn't have to mean exorbitant insurance costs. By implementing the tips and strategies Artikeld in this guide, you can make informed decisions to save on car insurance while staying protected on the road.

Popular Questions

What factors classify a driver as high-risk in Canada?

Factors such as a poor driving record, young age, and certain vehicle types can classify a driver as high-risk in Canada.

How do insurance companies determine discount eligibility for drivers?

Insurance companies consider factors like driving history, age, and the type of vehicle when determining discount eligibility for drivers.

What role do deductibles play in obtaining discounted insurance rates?

Higher deductibles typically result in lower insurance premiums, as the driver assumes more financial risk.

How can defensive driving courses help lower insurance premiums?

Defensive driving courses can demonstrate improved driving skills to insurance companies, potentially leading to lower premiums.

Is maintaining a good credit score important for lowering insurance premiums?

Yes, a good credit score can positively impact insurance premiums, as it reflects financial responsibility.